Companies and businesses that commonly make payments to non-employee vendors, service providers, and other entities likely noticed a relatively significant change in their tax form filing during the 2020 tax year due to the resurrection of Form 1099-NEC. While this may have tripped up some during their filing last year, the tax solution experts at Parachor Consulting are here to help ensure that all businesses fully understand the ins and outs of this new form going forward.

With their help, you can prevent a repeat of any previous filing mistakes and complications you may have encountered last year. Please continue to learn everything you’ll need to understand about this form and consider contacting the trusted professionals at Parachor to find out what they can do to benefit your business this tax season.

Related: IRC Section 174: Lower Tax Bills as an Investor

Table of Contents

What is Form 1099-NEC: Nonemployee Compensation?

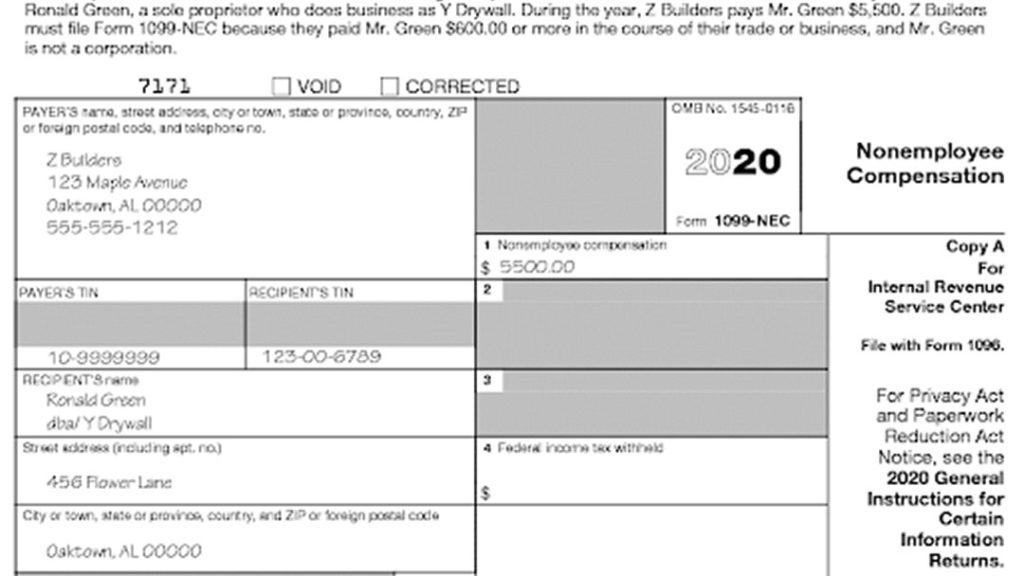

Form 1099-NEC is a form provided by the Internal Revenue Service (IRS) that was issued beginning in the 2020 tax year and is a redesign of a form of the same name used back in 1982. It’s utilized by businesses to report the payments they made to freelancers, independent contractors, self-employed individuals, and sole proprietors. Payments made for business or trade to US persons providing services will be reported on this document from now on. Aside from corresponding state and federal tax withholding information, this single income type is the only payment information reported via Form 1099-NEC.

Why Did the IRS Change from Form 1099-MISC to Form 1099-NEC?

In more recent years and before Form 1099-NEC’s reestablishment in 2020, employers would report nonemployee compensation in box 7 of Form 1099-MISC. Form 1099-NEC was refurbished and chosen for use to help address employer confusion and filing errors related to some of the dual-filing deadlines for FORM 1099-MISC. The change was also done to reduce significant instances of fraud relating to falsified 1099-MISC forms used to report small employee compensation and significant withholdings, which resulted in the request of many sizable refunds.

However, taxpayers should note that other income types such as rent, royalties, and other income will continue to be reported on Form 1099-MISC. Aside from some box removal and shuffling, no significant changes occurred to Form 1099-MISC.

Do you own a business and need the help of an experienced tax credit solutions provider to help you make use of all the tax benefits available to you? Please get in touch with the trusted professionals at Parachor Consulting to learn about everything they can do to help.

The Filing Implications Caused by Form 1099-NEC

The reintroduction of Form 1099-NEC caused some complications for tax filers last year, including issues in state reporting requirements, composite recipient statements, and multilevel marketing (MLM) filing. As businesses proceed into future tax seasons and continue to encounter Form 1099-NEC, there are several steps they can take to make the changes they face with this formless complex and reduce the number of challenges and filing errors they may encounter. Some of these steps include:

Related: Easily Calculate the R&D Tax Credit For Great Returns

Carefully Planning Communications

Communication is a critical key in making the transition from Form 1099-MISC to Form 1099-NEC, especially since many recipients still won’t understand the change in Form 1099 and why they’re receiving it, even though the change occurred last year. As a result, it’s essential to contact your payee population and communicate with them strategically to prevent errors or misunderstandings.

All filers of Form 1099 are required to submit a phone number on recipient statements that recipients can call if they encounter any questions or confusion. Consider sending a detailed communication regarding the Form 1099 changes with the recipient statements to help avoid an eventual onslaught of confused and agitated callers looking for explanations. You should also consider budgeting for additional call center time to talk with curious recipients about the change.

Coordinate with Relevant Stakeholders

If your business utilizes a third-party system, check-in with them to discuss how information flows will be similar to last year and how they will differ from years before 2020. Ensure that any reporting tools you utilize collect the correct data from all necessary sources and that you are using the proper templates for filling out tax information. Discuss any issues you encountered during the initial transition last year and how you can avoid them this year.

Utilize the IRS TIN Matching System

Issuing two versions of Form 1099 can put filing recipients in double jeopardy for B Notices, resulting in $270 per form charges. Utilize the IRS TIN matching system to help avoid B Notices, especially for recipients you know you’ll have to report before the end-of-the-year rush.

Related: Form 7200 Instructions 2021: Step-by-Step Guide

Review Reporting Populations and Test Systems Early to Avoid Mistakes

The IRS releases updated e-filing specifications every fall. Ensure that your business uses the newest specifications and undergoes any required testing to identify potential data gaps in your system that could lead to tax filing issues with the IRS FIRE System requirements.

Ask Key Questions and Determine Your Filing Strategy

You’ll need to determine the best possible filing strategy for your business and understand what your recipient communications will look like during tax season. You’ll want to prepare in advance, especially if you have backup withholding obligations on both Forms 1099-NEC and Form 1099-MISC. Some key questions to consider throughout this process are:

- Will you give recipients Form 1099-NEC and Form 1099-MISC together?

- Will you require additional resources to accomplish that task, or are you currently capable of doing so?

- Does your current system or service provider have the ability to accommodate the needs of your business?

- Do you need to update your system or provider to do so?

Suppose you’re unsure about any part of this process or about the critical questions above that you should be working diligently to answer. In that case, you could likely benefit from the services of a tax professionals like Parachor Consulting.

Are you trying to figure out the tax benefits currently available to you and your business before having to file for the upcoming tax season? Please reach out to the industry professionals at Parachor Consulting today to learn what we can do to help your business get all of the tax benefits it deserves.